In 2025, RovenMill presents itself as a modern wealth-management and investment platform, offering users access to a range of services from portfolio diversification to automated strategies and global market exposure. For investors seeking a blend of traditional investment tools and contemporary efficiency, RovenMill promises a balance of growth potential and professional management.

This RovenMill review examines what the platform claims to offer — its core services, how it works, the benefits and potential drawbacks — and assesses whether RovenMill may be a viable option for both new and experienced investors. The analysis aims to give you a clear, realistic overview before deciding whether to engage with the platform.

RovenMill defines itself as a financial firm specializing in wealth management, global investments and “legacy planning.”

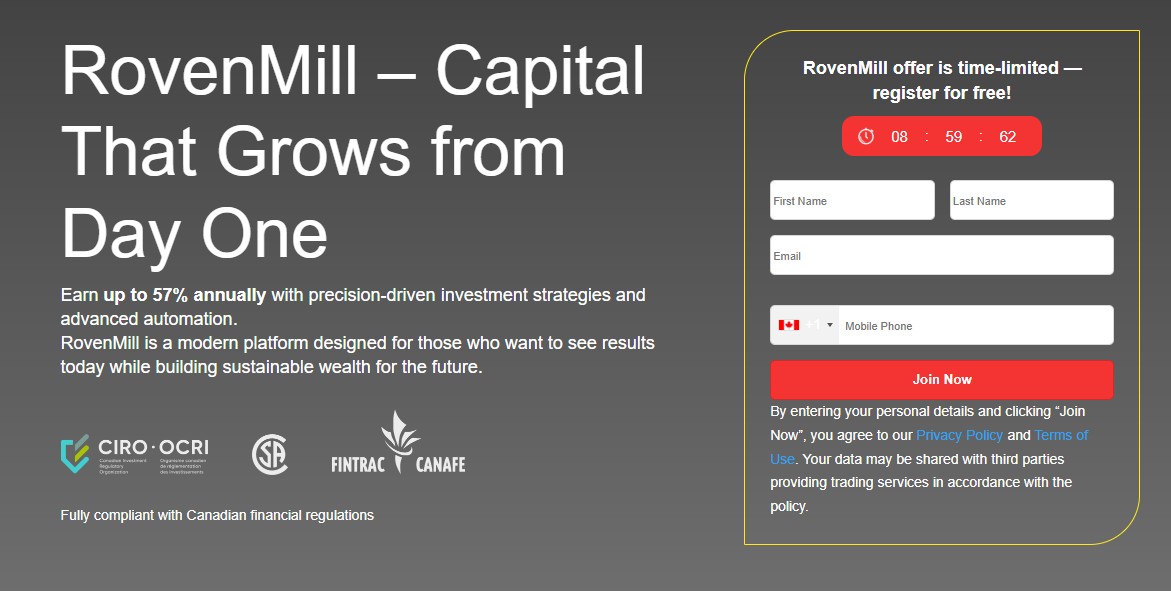

According to its website, the platform is fully compliant with Canadian financial regulations and claims to be registered and authorized by relevant regulatory bodies across Canada. RovenMill offers investment services including portfolio management, diversified asset allocation (equities, bonds, “alternative investments”), and broader wealth preservation strategies.

The premise is to provide access to global markets — not just traditional stock markets, but also diversified instruments — aiming for long-term growth and risk-balanced investment rather than speculative trading. :contentReference[oaicite:4]{index=4}

RovenMill is promoted with a number of features attractive to investors who want professionally managed portfolios and access to diversified investments. Here are some of the standout points.

One of the central claims of RovenMill is full compliance with Canadian financial regulations, with registrations and authorizations from key regulatory bodies. :contentReference[oaicite:5]{index=5} For investors, this suggests that the platform aims to operate with a baseline of transparency and legitimacy.

The offering is focused on wealth management — not “get-rich-quick” schemes — which can be more appealing for those looking for stable, long-term capital management.

RovenMill claims to build portfolios that include a mix of asset classes — from equities and bonds to “alternative investments,” which may include private placements, commodities or other less standard assets.

This diversified approach may help lower overall portfolio risk compared to putting all funds into a single asset class, offering a balanced exposure over medium and long-term horizons.

According to RovenMill’s materials, they provide more than just a “set-and-forget” system. The platform offers tailored wealth-management services, investment advisory, and legacy planning — implying more personalized financial planning rather than generic investment packages.

For users who value long-term financial stability, this kind of bespoke approach — combining different assets, adjusting risk, and possibly involving advisory support — may be more appropriate than high-risk, high-reward trading platforms.

RovenMill’s workflow is designed to integrate professional wealth management with user access and transparency. Based on publicly available information, the process generally follows these steps.

Prospective clients register on the RovenMill website. Contact information is collected, and users are invited to discuss their investment goals. According to their contact page, there is a dedicated team available to assist with account setup and strategy planning.

After onboarding, RovenMill works with clients to build a tailored investment portfolio. Based on the client’s risk tolerance, goals, and time horizon, the firm suggests a combination of assets — equities, bonds, alternative investments — to diversify holdings and balance risk.

As part of its services, RovenMill emphasizes long-term wealth preservation and legacy planning — helping clients structure their portfolios for sustainable growth, retirement planning, or intergenerational wealth transfer.

Once invested, RovenMill claims to provide ongoing management, periodic reviews, and adjustments as market conditions change or client’s goals evolve. The advisory component seems to be an integral part of the service, rather than a one-time setup.

Evaluating if RovenMill is “legit” — the platform provides several signals in favor of legitimacy. Its website states that it is registered and authorized under Canadian regulations.

Moreover, RovenMill appears to offer standard wealth management services (diversified portfolios, advisory support, legacy planning) rather than high-risk promises of guaranteed high returns — which often characterize untrustworthy schemes.

That said — as with all investment firms — legitimacy is only one factor. The real test lies in transparency: clarity about which assets are included in portfolios, fees, liquidity, and the real performance over time. Users should request all available documentation, check regulatory references, and begin with amounts they are comfortable investing.

For investors focused on long-term growth, wealth preservation, and balanced portfolio management, RovenMill may serve as a reasonable candidate — especially if they value compliance, diversification, and professional advisory support.

RovenMill builds diversified portfolios that may include equities, bonds and what the platform calls “alternative investments” — potentially private placements, commodities or other non-traditional assets.

According to the platform, RovenMill is registered and authorized under Canadian financial regulation.

No — RovenMill does not promise guaranteed high returns. Results depend on asset performance, diversification, and market conditions.

The platform may appeal to investors seeking medium- to long-term growth, wealth preservation, and diversified portfolios — especially those who prefer a regulated, professionally managed investment environment over high-risk trading.

You should review which assets will be included in your portfolio, ask for clear documentation on fees and liquidity terms, verify regulatory information, and begin with a sensible investment amount. Transparency and informed consent are key.