In the evolving world of online finance and wealth management, RovenMill positions itself as a convenient gateway for individuals looking to combine traditional investment principles with modern automation and diversified asset access. As the platform gains visibility in 2025, it’s worth examining what RovenMill offers — and where caution is needed — to see if it matches realistic expectations for both beginners and more experienced investors.

This RovenMill review explores the platform’s business model, key features, what real users say, the strengths and weaknesses, and an overall assessment of whether RovenMill appears legitimate enough to be considered by cautious investors.

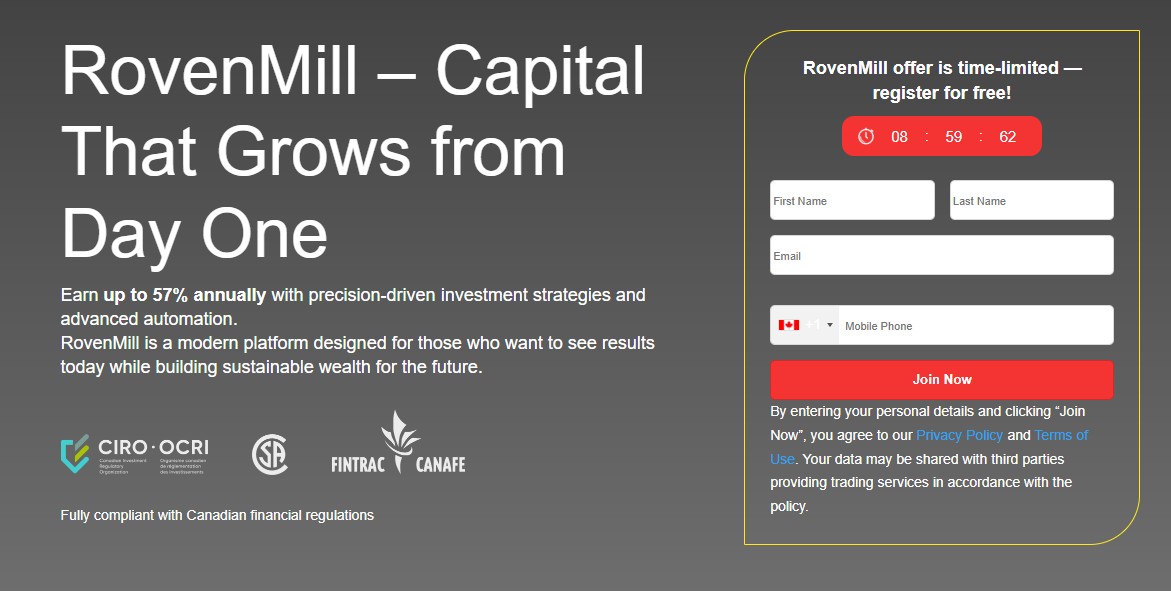

According to its website, RovenMill claims to be a regulated wealth management and investment platform operating under Canadian jurisdiction, offering services such as portfolio management, trading automation, diversified asset access (crypto, forex, derivatives), and long-term investment planning.

RovenMill presents itself as a bridge between traditional financial services and modern trading tools, aiming to make global markets — from crypto and CFDs to securities and derivatives — accessible via a unified platform.

Their stated mission is to provide "capital that grows from day one" through a combination of managed investments, automated strategies and diversified asset exposure.

RovenMill advertises several features designed to appeal to both newcomers and more advanced investors. Here are the main aspects that the platform highlights — and that require your attention.

RovenMill claims to be registered and compliant under Canadian financial regulation, listing various provincial authorities (e.g. regulatory bodies for securities, derivatives, virtual assets) across Canada as part of its compliance framework.

This regulatory claim, if accurate, would provide a basic layer of legal legitimacy and accountability — which can be more reassuring than many unregulated online investment schemes.

Users reportedly can access a broad range of markets: crypto, forex, CFDs, derivatives, and more — depending on the program or plan.

RovenMill offers a mix of services: from manual trading and portfolio building to algorithm-driven tools and automation — giving flexibility depending on user preference, risk tolerance, and experience level.

According to reviews, RovenMill allows a relatively modest minimum deposit (often cited around USD 250) and offers demo-mode access.

For traders new to online investing, such features lower the initial financial risk and allow testing the platform before committing significant funds — a positive sign in terms of user-friendliness and responsible onboarding.

Based on public documentation and user testimonials, here is how a typical experience with RovenMill might unfold.

Users start by registering on the official website. RovenMill claims to be compliant and regulated under Canadian financial laws.

After account creation and any necessary identity verification, you can fund your account. The modest minimum deposit is often noted as an advantage for small or cautious investors.

Depending on your goals and risk tolerance, you may opt for manual trading, automated trading tools/bots, or a diversified managed portfolio. RovenMill claims to support a broad array of instruments — giving flexibility.

The platform asserts that users receive ongoing support and access to analytics, portfolio tools, and possibly legacy-style wealth management services.

Evaluating whether RovenMill is legitimate yields a mixed picture. On one hand — the company claims Canadian regulatory registration across multiple provinces and suggests compliance with applicable securities/derivatives laws.

On the other hand — independent website-checks and ratings highlight serious warnings: according to one site, RovenMill’s trust score is “rather low,” citing factors such as a very young domain, hidden ownership data in WHOIS, low traffic metrics and heavy reliance on online reviews.

Additionally, many of the platform’s claimed advantages (automation success, wide asset access etc.) are difficult to independently verify. Without transparent audited performance data, any claim of steady returns or “easy growth” should be taken with caution.

For a cautious investor: RovenMill may be considered a potential tool — but only if approached conservatively, with small amounts, diversified funds, and clear understanding that risk remains significant.

According to user-feedback and independent reviews, a typical minimum deposit is about USD 250 — which makes it accessible for small investors.

Yes. RovenMill claims to support manual trading, algorithm-driven automated trading, and diversified portfolio management — giving flexibility to users depending on their goals and experience.

No. Like any platform dealing with volatile assets (crypto, CFDs, derivatives), returns are not guaranteed. Market fluctuations, strategy performance, and risk exposure play a major role. Even though RovenMill advertises high potential returns (e.g. up to 57% annually), such claims should be viewed with caution and not as a guarantee.

RovenMill shows some signs of legitimacy (regulatory claims, diversified offerings), but also triggers caution flags (young domain, low external trust-score, lack of independent verifiable performance data). If you choose to try it — it’s wiser to start with a small amount and treat it like a high-risk investment.

Users reportedly may access a variety of asset classes, depending on the account and broker: cryptocurrencies, forex, CFDs, derivatives. This breadth offers flexibility, but also increases complexity and risk.