As financial services continue moving toward digital-first experiences, RovenMill positions itself as a premium wealth-management and investment platform built for modern investors. With its focus on diversified portfolios, long-term wealth planning, structured investment solutions, and professional advisory services, RovenMill aims to offer something different from typical trading apps or speculative systems — a stable, guided, balanced approach to growing capital.

This RovenMill Review 2025 explores what the platform offers, how it works, its standout features, strengths and limitations, and whether it appears to be a reliable choice for carefully minded investors seeking a structured way to build long-term wealth.

RovenMill is presented as a wealth-management platform that blends traditional investment approaches with modern accessibility. Unlike pure trading platforms that focus heavily on short-term speculation, RovenMill claims to specialize in:

— structured portfolio building;

— multi-asset diversification;

— long-term wealth and legacy planning;

— personalized advisory support;

— risk-managed investment strategies.

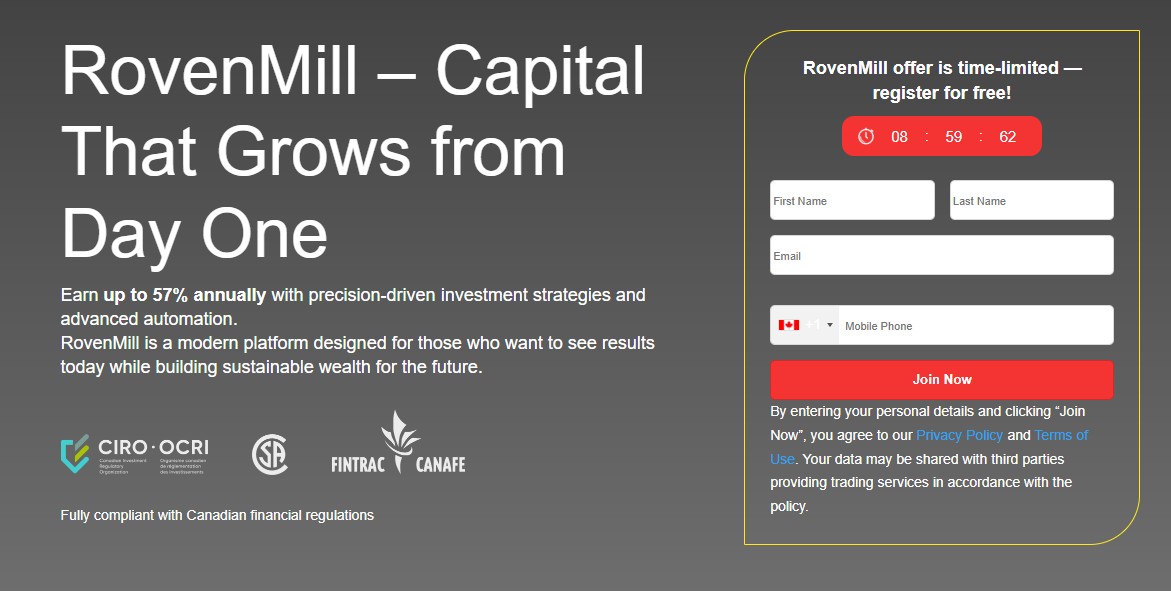

Its messaging emphasizes security, professionalism, and alignment with Canadian compliance principles — aiming to deliver a more “institutional-style” investment experience to everyday investors.

RovenMill markets itself as a premium, guidance-oriented investment service. Here are the features that define its offering and attract attention in 2025.

One of the strongest elements of RovenMill is its emphasis on portfolio diversification. The platform claims to allocate client capital across a combination of:

— equities;

— fixed-income instruments;

— alternative assets;

— selected global markets;

— long-term investment products.

Diversification plays a central role in wealth preservation and controlled growth, and RovenMill places this concept at the core of its strategy.

Beyond portfolio management, RovenMill differentiates itself through its emphasis on legacy and long-term financial planning. This includes:

— retirement strategies;

— intergenerational wealth planning;

— multi-year growth projections;

— capital preservation frameworks.

These services appeal to users who think beyond short-term trades and want structured, secure, long-lasting growth.

According to its messaging, RovenMill relies heavily on human support and advisory assistance. This is not a purely “self-serve” platform — instead, investors get access to guidance during onboarding, portfolio structuring, and ongoing adjustments.

For new investors or those who prefer direction over trial-and-error, this feature can be a major advantage.

While the specifics may vary by account type, the RovenMill user journey typically consists of the following steps:

Users sign up on the platform and are introduced to its wealth-management services. The process may include a consultation to define financial goals, risk tolerance, and timelines.

Based on user goals, RovenMill creates a customized investment plan. This may include:

— asset allocation;

— diversification choices;

— risk-profile calibration;

— long-term growth pathways.

The strategic approach is designed to match each user's financial objectives.

Once users approve their investment direction, they deposit funds to activate their portfolio. Starting amounts may vary depending on program and region.

RovenMill claims to continuously monitor portfolios and adjust allocations when needed — ensuring balance across changing market conditions.

Users receive periodic performance insights, strategic updates, and, if needed, advisory assistance for adjusting their financial plan.

The legitimacy question is crucial. RovenMill presents itself as a compliance-aligned wealth-management firm adhering to Canadian principles of financial conduct.

Positive indicators include:

— professional positioning;

— long-term investment structure instead of speculative trading;

— emphasis on diversification and risk moderation;

— advisory-based client communication.

However, as with any wealth-management service, transparency is key. Potential investors should:

— request verification of licensing and compliance references;

— review all portfolio documentation;

— understand investment fees, terms, and exit structures;

— begin with an amount that aligns with their risk tolerance.

RovenMill appears structured for long-term, stability-focused investors rather than short-term traders. With appropriate caution and due diligence, it may serve as a solid option for wealth-building strategies.

RovenMill focuses on long-term wealth management and diversified portfolios rather than speculative or high-frequency trading. Its approach is slower, structured, and designed for stability.

No — like all legitimate financial firms, it does not guarantee performance. Market risk remains a normal part of investing.

Individuals seeking long-term, professionally guided investment solutions — especially those planning retirement, building generational wealth, or pursuing portfolio diversification.

Yes. Its advisory model, guided onboarding, and structured investment process make it accessible even for people with minimal investment experience.

Portfolios may include equities, fixed-income products, global markets, and alternative assets depending on selected programs and risk tolerance.