In an investment world often dominated by volatility, speculative trading, and fleeting trends, CanPeak Resources stands out by offering a different approach — real-asset investing focused on Canada’s resource, energy, mining, and infrastructure sectors. In 2025, more investors are looking for stability, tangible value, and long-term potential. This review explores how CanPeak Resources aims to deliver just that, by giving individuals access to projects backed by natural resources and commodities — industries that underpin Canada’s economy.

This CanPeak Resources review dives into what the platform offers, how it operates, what advantages it provides, and which risks and limitations are worth attention. It’s meant for investors who seek clarity, transparency — and a grounded alternative to high-risk speculation.

CanPeak Resources is an investment platform offering access to project-based and asset-backed investments across Canada’s resource economy: energy, mining, metals, natural resources, and infrastructure-related endeavors. According to the official website, the platform connects everyday investors with opportunities that used to be available mostly to institutions.

The main mission of CanPeak Resources is to bridge the gap between private investors and large-scale resource projects. By doing so, it promises transparency, reasonably low entry thresholds (the site mentions a minimum starting point) and diversified exposure to sectors with potential long-term structural growth.

Instead of focusing on high-frequency trading or speculative crypto swings, CanPeak emphasizes investments tied to tangible assets — resources, commodities, mining output, and infrastructure — which may appeal to conservative or long-term-oriented investors seeking stability and foundational value.

What makes CanPeak Resources attractive — especially for investors tired of purely speculative platforms — are several core features that define its offering. Below are the most notable.

CanPeak Resources allows investors to participate in real projects grounded in Canada’s natural resource and commodity sectors. This means your capital is (in principle) linked not to abstract promises but to physical assets and industries — from mining operations and metal extraction to energy production and infrastructure development.

For investors who value tangibility and want to avoid the wild swings common in speculative markets, this kind of exposure can represent a more stable, long-term oriented investment horizon.

One of the biggest advantages is that CanPeak Resources advertises a relatively modest minimum entry threshold, making it accessible even to retail investors who don’t have large capital sums. According to the site, you can start with a small amount and still gain exposure to large-scale resource projects.

This democratizes access to resource-backed investing — which traditionally has been limited to institutional or high-net-worth investors — and allows everyday individuals to participate in sectors with serious growth potential.

CanPeak Resources claims to offer flexibility: investors can choose to invest directly into individual projects or opt for diversified pooled funds that spread risk across multiple sectors. This helps manage risk and avoids putting all eggs into one basket — especially in industries like mining or commodities, where demand and market conditions may fluctuate.

For investors seeking balance between yield and risk, pooled funds offer a more conservative path, while direct project investments may appeal to those willing to take slightly higher risk for potentially higher returns.

The user journey on CanPeak Resources is described as fairly straightforward. Below is a breakdown of how the platform operates, based on publicly available information.

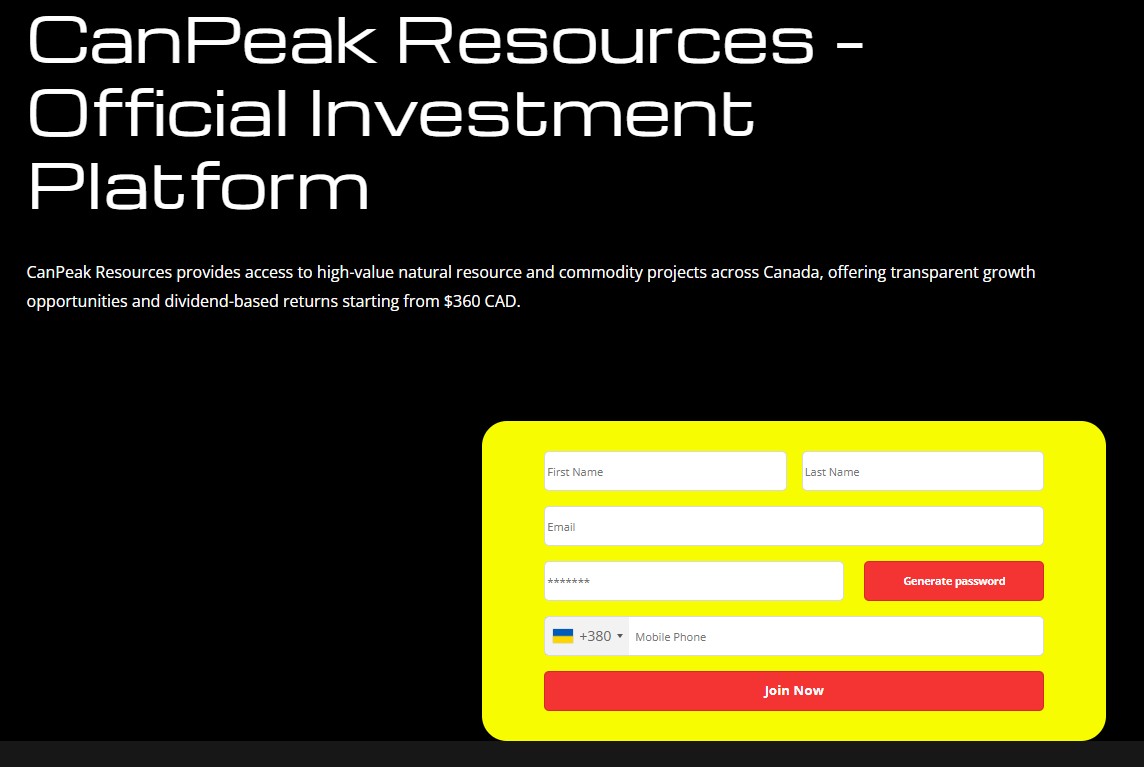

To get started, you need to create an account on the CanPeak Resources website. Typically, this involves providing basic personal information and agreeing to terms of use.

After registration, users may receive a call or contact from a CanPeak representative, who guides them through the investment process. This includes helping choose between direct projects or pooled funds, explaining the structure of investments, and clarifying payouts or dividend mechanisms.

Once you decide on the investment direction, you deposit funds — reportedly starting at a low minimum. From there, your capital is allocated to the selected project(s) or pooled funds.

According to the platform, investments are linked to real resource projects, and returns come via scheduled dividends or profit-sharing, depending on project performance. Users can monitor their positions, returns, and project status via a dashboard provided by CanPeak Resources.

This model attempts to combine the advantages of asset-backed investing (stability, long-term potential) with the accessibility and usability of online investment platforms.

Assessing legitimacy for investment platforms like CanPeak Resources requires careful consideration. On the positive side, the platform highlights that investments are backed by real natural resource and commodity projects, offers relatively transparent entry thresholds and claims to offer dividend-based returns. :contentReference[oaicite:11]{index=11}

Furthermore, CanPeak provides contact information reportedly based in Canada, including a mailing address in Ottawa, which may help with transparency and accountability.

Despite these factors, investors should remain cautious and conduct due diligence. Key questions to verify before investing include:

— Which specific projects your funds will be allocated to — is there public documentation or project-level transparency?

— What are the terms of dividends or profit-sharing — how are they calculated, and on what obligations or market conditions do they depend?

— Liquidity and exit options — what are the conditions and timelines for withdrawing initial capital or profits?

— Regulatory compliance — while CanPeak claims to operate under Canadian framework, it’s wise to check whether the underlying entities are formally registered, licensed, and audited.

For investors who approach with realistic expectations — treating investments as long-term, understanding risks, and diversifying — CanPeak Resources can serve as one of many tools for building a resource-backed portion of a broader portfolio.

CanPeak Resources is generally suited for individuals seeking long-term exposure to real assets, resource sectors, and commodity-backed investments. If you prefer stability and are willing to hold your investment over months or years rather than seeking quick trading profits, this platform may be a reasonable match.

According to the official site, investments start from a relatively modest threshold — making it accessible even for small-scale investors.

While CanPeak Resources advertises dividend-based returns linked to actual project performance, no returns can be guaranteed — resource and commodity markets fluctuate, production and demand evolve, and project outcomes can vary. Investors should treat results as subject to market and execution risk.

Withdrawal conditions depend on the project or fund structure. Because investments are tied to resource projects, liquidity may be more limited compared to publicly traded assets; investors should carefully review contract terms for exit conditions and redemption options before investing.

The platform provides some transparency on its website regarding project focus areas, sectors, and investment model, and it offers contact information and support channels. However — as with many private investment platforms — verifying project-level documentation, audit reports, and third-party confirmations is important for full clarity.